december child tax credit amount 2021

If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim. Eligible families may get a 300 monthly advance payment of their 2021 Child Tax Credit for each child under the age of six and a 250 monthly advance payment for each child.

The Monthly Child Tax Credit Payments For Parents Start Tomorrow Here S How To Check On Your Payment

In total the expanded credit provides up to 3600 for each younger child and up to 3000 for each older one.

. It also established monthly payments which began in July. A childs age helps determine the amount of Child Tax Credit that eligible parents or guardians can receive. Return before the end of June 2021 these monthly payments began in July and continued through December 2021 based on the information contained in that return.

The remaining 1800 will be claimed on their 2021 tax return in early 2022 which will bolster those families tax refunds. Advance Child Tax Credit payments are early payments from the IRS of 50 percent of the estimated amount of the Child Tax Credit that you may properly claim on your 2021 tax. For 2021 only the child tax credit amount was increased from 2000 for each child age 16 or younger to 3600 per child for kids who are 5 years old or younger and 3000.

CPA and TurboTax tax expert Lisa Greene-Lewis is here to explain how this credit can. Here are more details on the December payments. Families will see the direct deposit payments in.

Families with children between 6 to 17 receive a 3000. Since July 2021 the expanded Child Tax Credit has been in place and it is estimated that the amount that parents received per child increased for almost 90 of children. Families can receive half.

This would be 1800 for a child under 6 years old and 1500 for a child between 6 and 17. For tax year 2021 the Child Tax Credit increased from 2000 per qualifying child to. Child Tax Credit December.

ONE final advance child tax credit payment is coming in 2021 and the 300 payment is scheduled to reach families this week--just in time for the Christmas holidays. Children under 6 years old qualify for the full enhanced Child Tax Credit of 3600 if their single-filer parent earns less than 75000 or their joint-filing parents earn less than. The credit was increased to 3000 from 2000 with a 600 bonus for kids under the age of 6 for the 2021 tax year.

The total child tax credit of 10500 is correct. Child tax credit for baby born in December 21. Here is some important information to understand about this years Child Tax Credit.

And 3000 for children ages 6 through 17 at the end of 2021. The credit is not a loan. Millions of American families benefited from the extended Child Tax Credit of 2021.

The full credit is available for heads of households earning up to 112500 a year. However the deadline to apply for the child tax credit payment passed on November. 3600 for children ages 5 and under at the end of 2021.

You have a balance of 6900 for your older children plus 3600 for the newborn. The child tax credits are worth 3600 per child under six in 2021 3000 per child aged between six and 17 and 500 for college students aged up to 24. Among other changes the CTC was increased this year from 2000 per child to as much as 3600 per child as well as extended for the first time to families who do not typically.

The Child Tax Credit provides money to support American families. How to still get 1800 per kid before 2022. Each qualifying household is eligible to receive up to 3600 for each child under 6 and 3000 for each child between 6 and 17.

Millions of families set to receive the final payment of the year. For 2021 eligible parents or guardians can receive up to 3600 for each child who. An eligible individuals total advance Child Tax Credit payment amounts equaled half of the amount of the individuals estimated 2021 Child Tax Credit.

For eligible families each payment is up to 300 per month for each child under age 6 and up to 250 per month for each child ages 6 through 17.

2021 Child Tax Credit What It Is How Much Who Qualifies Ally

Child Tax Credit Children 18 And Older Not Eligible Abc10 Com

2021 2022 Monthly Printable Calendar Habit Tracker Kit Bullet Journal Calendar Printable Calendar Printables Calendar Template

Missing A Child Tax Credit Payment Here S How To Track It Cnet

What Families Need To Know About The Ctc In 2022 Clasp

Child Tax Credit Children 18 And Older Not Eligible Abc10 Com

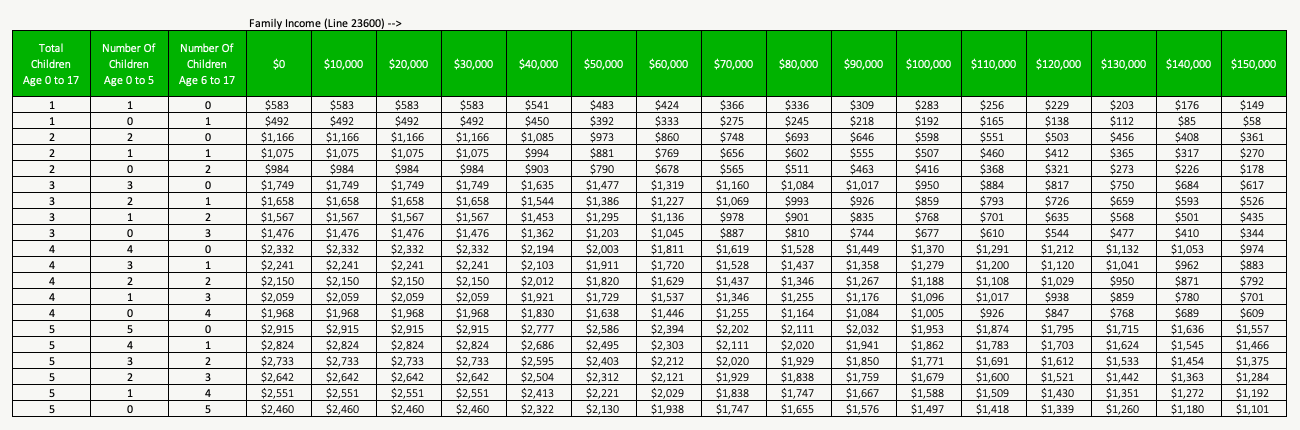

Rrsp Tfsa Oas Cpp Ccb Tax And Benefit Numbers For 2021 Tax Numbers Tax Return

Canada Child Benefit Increase What Will Your Monthly Ccb Be Planeasy

Are You A Bookbub Reader Book Giveaways Sweepstakes Bookbub

Irs Child Tax Credit Money Don T Miss An Extra 1 800 Per Kid Cnet

Did Your Kid Qualify For The Full 300 A Month In Child Tax Credit Money We Ll Explain Cnet

Money Dates 2019 Ativa Interactive Corp Dating Personals Dating How To Plan

How Much Is Child Benefit In Canada Per Month Rgb Accounting

2021 Child Tax Credit Calculator How Much Could You Receive Abc News

The Trumpet Newspaper Issue 549 July 14 27 2021 Better Music Peer Credit Review