accumulated earnings tax c corporation

The accumulated earnings tax imposed by section 531 shall apply to every corporation other than those described in subsection b formed or availed of for the purpose of avoiding the income tax with respect to its shareholders or the shareholders of any other corporation by permitting earnings and profits to accumulate instead of being divided or distributed. Recently the Tax Court had an opportunity to consider the computation of this penalty tax.

What Are Accumulated Earnings Definition Meaning Example

However if a corporation allows earnings to accumulate beyond the reasonable needs of the business it may be subject to an accumulated earnings tax of 20.

. For example Ohio does not tax a C corporations net income. A personal service corporation PSC may accumulate earnings up to 150000 without having to pay this tax. For C corporations the current accumulated retained earnings threshold that triggers this tax is 250000.

The risk of incurring such tax is usually associated with the closely-held company but there is per. Accumulated Earnings Tax. When the revenues or profits are above this level the firm will be subjected to accumulated earnings tax if they do not distribute the dividends to shareholders.

Keep in mind that this is not a self-imposed tax. If a C corporation retains earnings above a certain amount the corporation may be assessed a tax penalty called the accumulated. Breaking Down Accumulated Earnings Tax.

There is no IRS form for reporting the AET. The accumulated earnings tax is a 20 tax that will be applied to C corporations taxable income. C corporations may accumulate earnings up to 250000 without incurring an accumulated earnings tax.

C corporations can earn up to 250000 without incurring accumulated earning tax. The accumulated earnings tax is considered a penalty tax to those C corporations that have accumulated over 250000 in earnings 150000 for PSC corporations and if that excess amount has not been distributed to shareholders in the form of a dividend. If imposed the earnings are subject to triple taxation when eventually.

In periods where corporate tax rates were significantly lower than individual tax rates an obvious. Its purpose is to prevent the accumulation of earnings if the reason for such is for shareholders to avoid paying taxes by not paying dividends. At the federal level Sec.

Ad Talk to a 1-800Accountant Small Business Tax expert. The tax is in addition to the regular corporate income tax and is assessed by the IRS typically during an IRS audit. This decreases government tax revenues because shareholders are unlikely to sell their valuable.

Once the year-end processing has been completed all of the temporary. Accumulated Earnings Tax. Breaking Down Accumulated Earnings Tax.

The characterization of the distribution is governed by Section 1368 c. Traded stock IRC section 532c. Accumulated Earnings Tax is a corporate-level tax assessed by the IRS.

REASONABLE NEEDS OF THE BUSINESS. The AET is imposed in addition to the regular corporate income tax. The accumulated earnings tax is equal to 20 of the accumulated taxable income and is imposed in addition to other taxes required under the Internal Revenue Code.

If an S corporation has accumulated EP tax-free distributions generally can be made to the extent of the corporations AAA. Receive Personal Attention From a Knowledgeable Business Incorporation Expert. The tax rate is 20 of accumulated taxable in-come defined as taxable income with adjustments including the subtraction of federal and foreign income taxes.

Most corporations are allowed to hold up to 250000 in retained earnings before they are subject to the accumulated earnings. The accumulated earnings tax is a 20 penalty that is imposed when a corporation retains earnings beyond the reasonable needs of its business ie instead of paying dividends with the purpose of avoiding shareholder - level tax seeSec. A corporation may be allowed an accumulated earnings credit in the na-.

To prevent companies from doing this Congress adopted the excess accumulated earnings tax provision of IRC section 535. A corporation can accumulate its earnings for a possible expansion or other bona fide business reasons. Whether the corporation made systematic attempts to obtain repayment.

C corporations can earn up to 250000 without incurring accumulated. The corporations ratio of debt to equity. An IRS review of a business can impose it.

If a corporation accumulates earnings that exceed the exemption amounts an accumulated earnings tax of 20 15. IRM 48821 Accumulated Earnings Tax discusses that the burden of proof is on the Commissioner unless a notification is sent to the taxpayer under IRC 534 b. Now Offering Even Lower Prices - Start Here.

As mentioned above if a Personal Service Corporation accumulates more than 150000 in earnings it crosses the reasonable line and can trigger the 20 Accumulated Earnings Tax. There is no IRS form for reporting the AET. The tax is in addition to the regular corporate income tax and is assessed by the IRS typically during an IRS audit.

Tax Rate and Interest. The corporation gets a tax deduction for rent paid and the shareholder reports rental income on his or her personal return. The tax rate on accumulated earnings is 20 the maximum rate at which they would be taxed if distributed.

535b retained in the business in excess of its reasonable needs. Filed its 1995 tax return showing a liability of 2674 which it paid in March 1996. The accumulated earnings tax is an annual tax levied on modified taxable income Sec.

May 17th 2021. There is a certain level in which the number of earnings of C corporations can get. Metro Leasing and Development Corp.

A corporation can pay rent to a shareholder for use of the shareholders personal property. The net amount of the balances shifted constitutes the gain or loss that the company earned during the period. We have the experience and knowledge to help you with whatever questions you have.

IRC 1368 c 1. Accumulated Earnings Tax There is an accumulated earnings tax designed to bar corporations from keeping earnings on reserve rather than distributing them to shareholders as dividends thereby skirting tax responsibility. Ad 40 Years of Lightning-Fast Filings.

A Personal Services Company PSC can make profits of up to 150000 without having to pay these fees. The threshold is 25000 without accumulated earning tax. If the distribution does not exceed the AAA the distribution is treated as if made by an S corporation with no accumulated.

If a corporation pursues an earnings accumulation strategy where the accumulation is to avoid the tax on dividends rather than having a business purpose then IRC 532 provides an accumulated earnings tax that can be assessed on accumulated earnings with no clear business purpose. It is presumed that a corporation can retain up to 25000000 or 15000000 for certain service corporations for. Publicly held corporations with many.

Get the tax answers you need. The tax rate is 20 of accumulated taxable in-come defined as. This is because corporations that do not spend retained earnings are generally more valuable than those without accumulated retained earnings.

If the accumulated earnings tax applies interest applies. Our system imposes a 20 percent tax on accumulated taxable income of a corporation availed of to avoid tax to shareholders by permitting earnings and profits to accumulate rather than being paid out. The IRS considers an LLCC-Corp to be a Personal Service Corporation if it passes both the following tests.

At the end of the fiscal year closing entries are used to shift the entire balance in every temporary account into retained earnings which is a permanent account. 1202 allows for the exclusion of up to 100 of the tax on the sale of C corporation stock. A tax imposed by the federal government upon companies with retained earnings deemed to be unreasonable and in excess of what is considered ordinary.

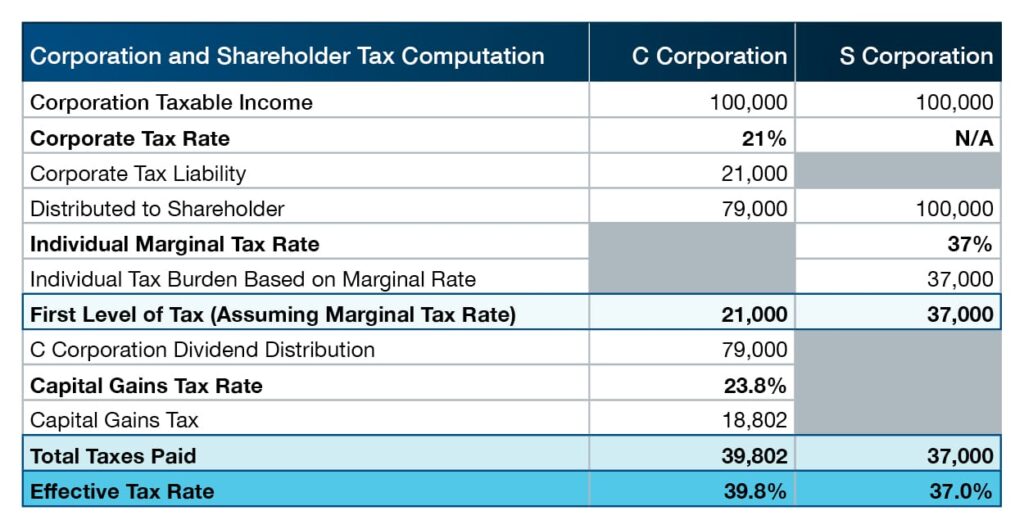

How the accumulated earnings tax interacts with basic C corporation planning Choice-of-entity planning involving C corporations often revolves around a plan to operate a business through a C corporation to take advantage of the low 21 federal corporate income tax rate retain earnings in the corporation by minimizing compensation and dividends. The accumulated earnings tax is computed on the corporations accumulated taxable income for the taxable year or years in question. Calculation of Accumulated Earnings.

Cares Act Implications On Corporate Earnings And Profits E P

Will C Corporations Be The Come Back Kid Of 2018

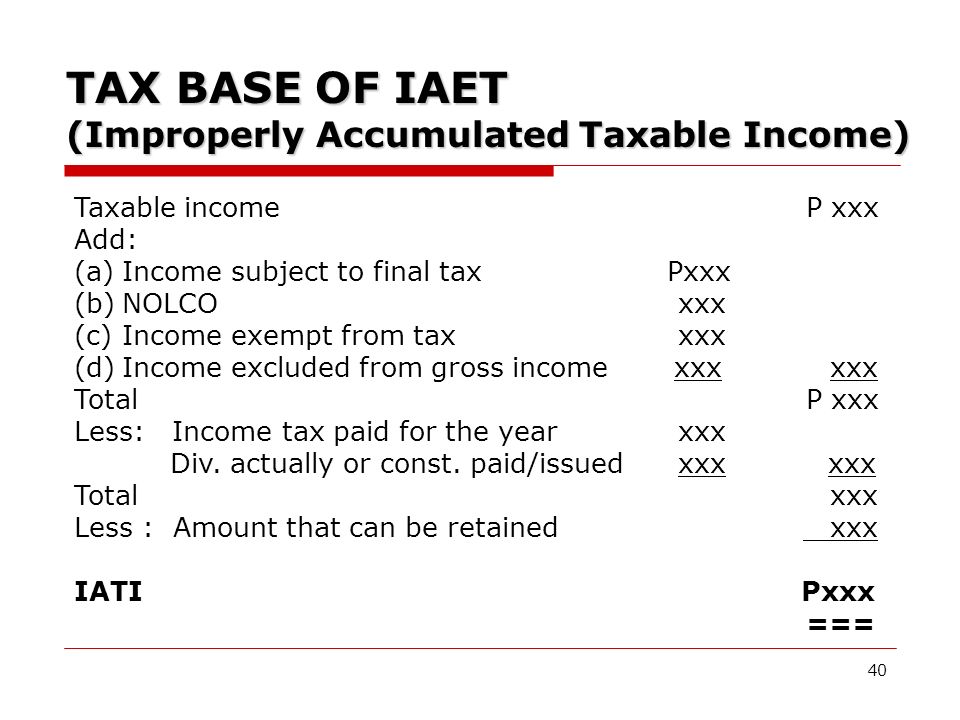

Income Tax Computation Corporate Taxpayer 1 2 What Is A Corporation Corporation Is An Artificial Being Created By Law Having The Rights Of Succession Ppt Download

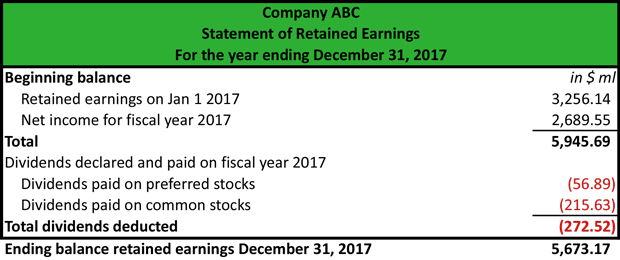

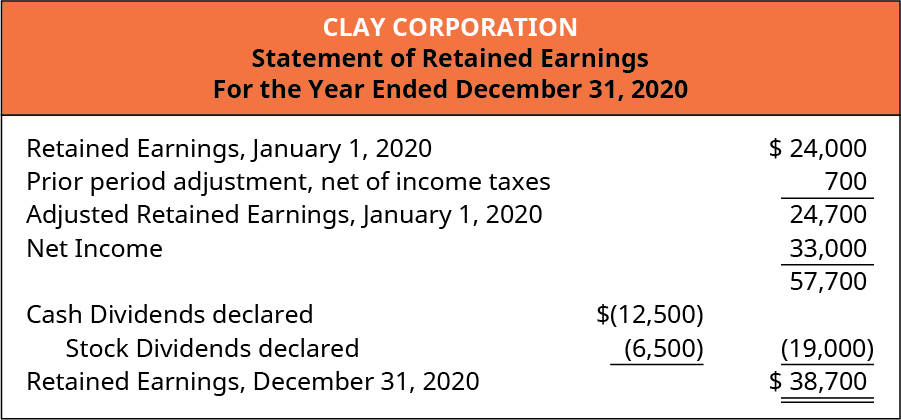

Compare And Contrast Owners Equity Versus Retained Earnings Principles Of Accounting Volume 1 Financial Accounting

Earnings And Profits Computation Case Study

Earnings And Profits Computation Case Study

Solved Please Note That This Is Based On Philippine Tax System Please Put Course Hero

Earnings And Profits Computation Case Study

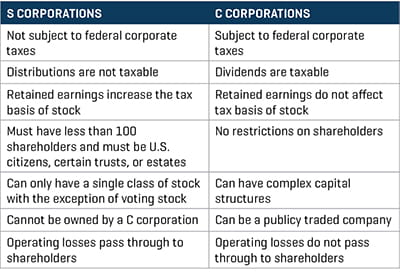

S Corporation Or C Corporation Under The Tax Cuts And Jobs Act Pya

Determining The Taxability Of S Corporation Distributions Part Ii

Darkside Of C Corporation Manay Cpa Tax And Accounting

What Is A C Corporation What You Need To Know About C Corps Gusto

Understanding The Accumulated Earnings Tax Before Switching To A C Corporation In 2019

Strategies For Avoiding The Accumulated Earnings Tax Krd Ltd

Demystifying Irc Section 965 Math The Cpa Journal

Oh How The Tables May Turn C To S Conversion Considerations Stout